The minimum interval between 2 successive cork extractions from the same tree is fixed by law as 9 years in Portugal. Postponing cork extraction to more than 9 years is an option that results (or not) in a variation of the cork price (for the same structure of cork prices). Site productivity, cork thickness and quality and discount rate contribute to the profitability of the farm, which may be evaluated, for example, by the equivalent annual annuity (EAA). The objective is to apply the SUBER model to evaluate the influence of the cork debarking rotation period (CDR) variation, from 9 to 11 years, on the EAA of different stands by analysing the opportunity to increase the market price of extracted cork.

Cork thickness helps the industrial classification for quality and determines cork price. Increased annual cork growth and/or CDR increases thickness. Landowners may postpone cork debarking to increase cork width and thus price.

Cork sampling and the SUBER model are management tools to estimate cork thickness and support forest managers in deciding the duration of CDR. Applying cork sampling results to initialise the model allows simulating cork thickness evolution in the coming years, followed by an economic analysis of the effect of postponing cork extraction, based on the EAA.

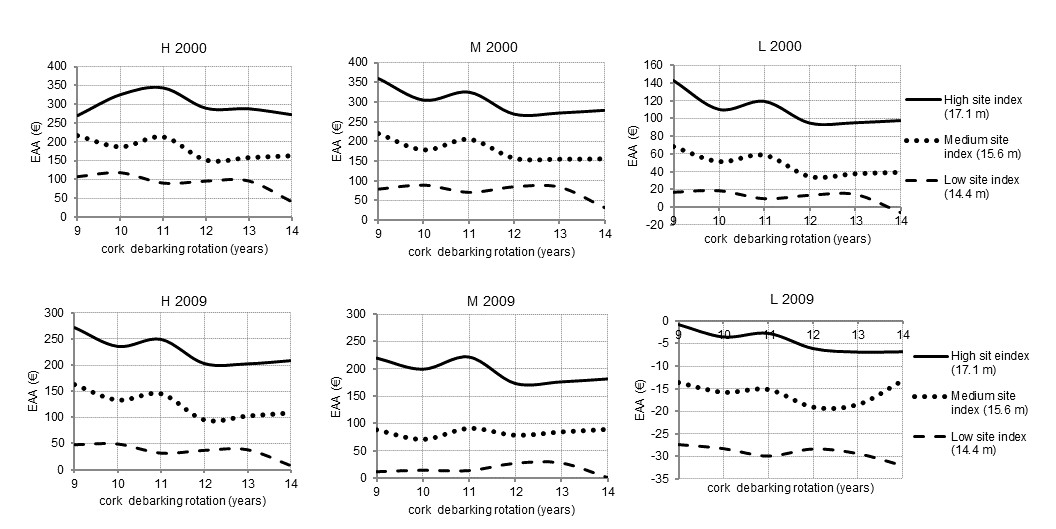

- The EAA is maximised by site index, cork quality and cgi distributions.

- In stands characterised by high or medium site index and cork characteristics (quality and growth index), the scenarios considering discount rates of 0.5% and 2% provide similar values of EAA, when postponing the debarking for CDR values to 11 years. Stands characterised by low site index or cork characteristics presented lower, nearly constant, and in some cases, negative EAA values, irrespective of the CDR considered.

- For the simulations carried out with a discount rate of 5%, the EAA decreases with the increase of CDR, indicating that the minimum legal value of nine years for CDR should be applied.

Climate is known to affect cork annual growth and ultimately cork thickness. In recent years, there was an increase in the frequency of severe drought events in Portugal. As a result, for the same debarking rotation period, cork thickness may show a decreasing trend that may negatively impact cork price.

Among the essential parameters that assist the decision of whether to delay the debarking operation are the following:

- Detailed knowledge of cork and stand characteristics based on the collection of samples in a forest inventory;

- Awareness of climate conditions during the period of cork growth, namely precipitation regimes;

- Collection of updated information on cork price structures and work labour costs.

Annual cork growth is known to be highly related to climate conditions, namely precipitation regimes, but it is also highly variable between and within farms/stands. The importance of site conditions such as soil depth and texture, management practices and tree genetic variability imply that management operations, such as cork debarking, should be decided based on monitoring activities such as forest inventory and cork sampling.

Cork price and labour cost fluctuations and uncertainties are also relevant drivers for farmers, which may affect the decision on the best time for cork debarking.

There is a need for increased knowledge on the quantification of the impact of soil and topographic characteristics and management operations (e.g. fertilisation) of cork growth and quality. This knowledge may be included in the management and decision support tools, such as forest growth models and simulators, that should be accessible to managers.

Joana Amaral Paulo, joanaap@isa.ulisboa.pt

Margarida Tomé, magatome@isa.ulisboa.pt

Further information

Paulo, J. A., Tomé, M. 2017 Using the SUBER model for assessing the impact of cork debarking rotation on equivalent annual annuity in Portuguese stands. Forest systems. 26(1), e008, 11 pages. https://doi.org/10.5424/fs/2017261-09931

Paulo, J. A., Pereira, H., Tomé, M. 2017. Analysis of variables influencing tree cork caliper in two consecutive cork extractions using cork growth index modeling. Agroforestry Systems 91(2): 221-237. http://dx.doi.org/10.1007/s10457-016-9922-2

Cork pile in Portugal. Credits: Joana Amaral Paulo

Equivalent annual annuity (EAA) for discount rate of 2% as a function of cork debarking rotation for stands with different site index (14.4 m, 15.6 m or 17.1 m). Cork prices structure from the year 2000 (high price scenario) is presented in the above part of the figure, and cork prices structure from the year 2009 (low price scenario) is presented below. H, M and L initials identify stands with high, medium or low fraction of good quality and thick corks, respectively.